Homeowners Insurance in and around West Plains

West Plains, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Being a homeowner isn’t always easy. You want to make sure your home and the possessions in it are protected in the event of some unexpected loss or catastrophe. And you also want to be sure you have liability insurance in case someone hurts themselves on your property.

West Plains, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

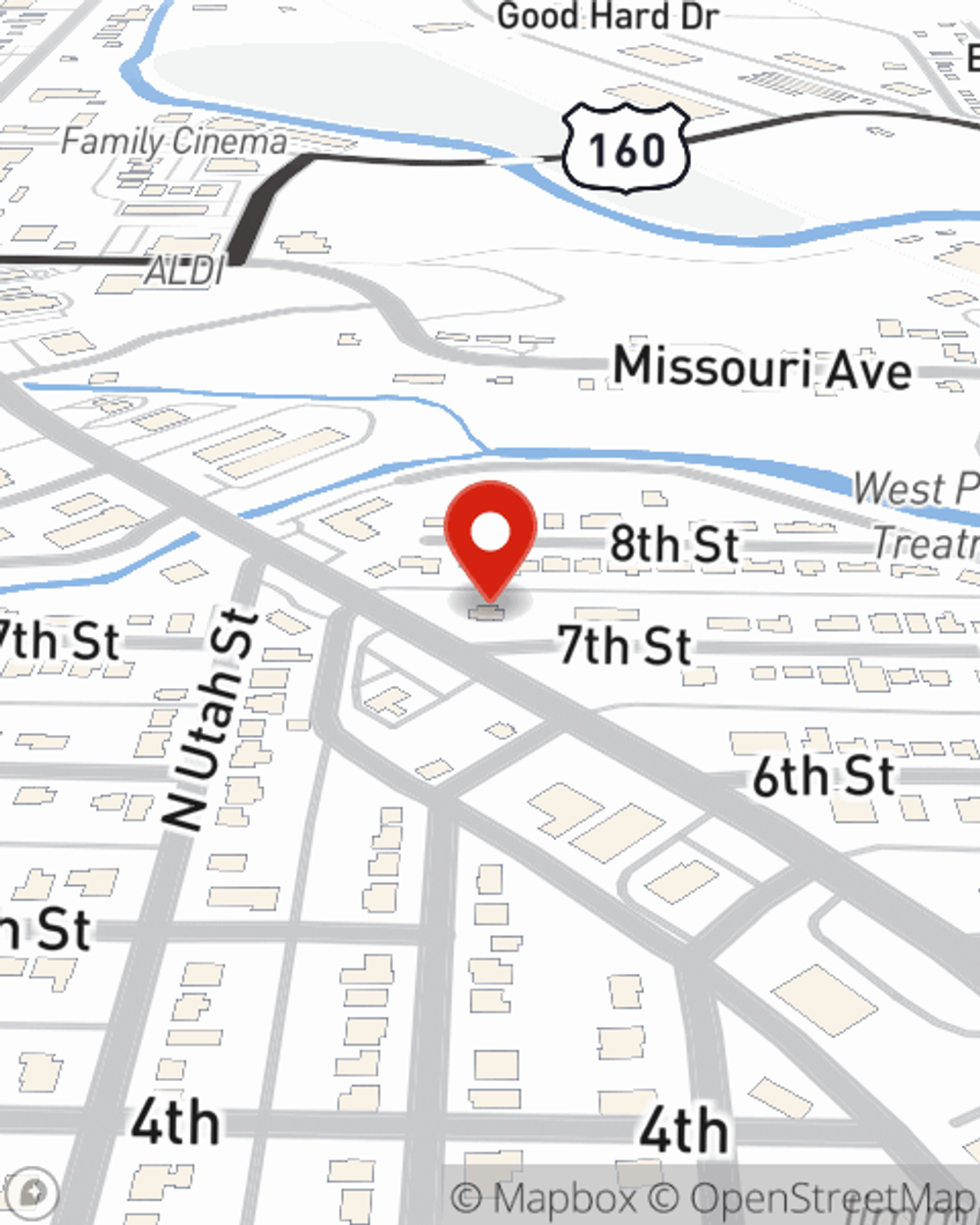

Agent Ramona Heiney, At Your Service

State Farm Agent Ramona Heiney is ready to help you prepare for potential mishaps with great coverage for your home insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Ramona Heiney can help you submit your claim. Find your home sweet home with State Farm!

Ready for some help getting started on a homeowners insurance policy? Call or email agent Ramona Heiney's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Ramona at (417) 256-2744 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Ramona Heiney

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.